![[Excelerate] Website OG Images 1200X630 (1)](/media/fl3jzfxl/excelerate-website-og-images-1200x630-1.png)

How AI is Revolutionising the Financial Services Industry in Malaysia

Nik Sharmine A

Published on Jul 17, 2024

Share this Article

ChatGPT by OpenAI is no longer a name that is unheard of across the world. According to the website, 92% of Fortune 500 companies globally are already using OpenAI in their business. Of course, that statistic includes companies in the financial services institution. Before the use of AI, banks relied heavily on human labour to complete their daily tasks. Activities such as data entry, record-keeping, and processing transactions were done by bank employees manually. This traditional approach had a higher chance of human errors, especially when dealing with data. According to Verizon’s 2024 Data Breach Investigations Report (DBIR), 68% of data breaches are caused by a human element.

Source: Verizon’s 2024 Data Breach Investigation Report

A mistake as simple as accidentally sending out confidential emails to the wrong recipient can have a lasting impact. A real-life example is the recent incident with the Australian government's finance department, which experienced its second data leak in four months. This breach resulted in 236 emails being sent to suppliers, containing third-party confidential information, including price scales from companies such as Deloitte, KPMG, and other consulting firms.

However, with the emergence of big data in the past decade, the financial services industry has adopted a more digitalised approach, utilising AI to analyse vast amounts of data to optimise efficiency in their operations. Banks like CIMB Malaysia are already prioritising digitalisation efforts, recognising the importance of automating their processes. In April this year, the CEO, Datuk Rahman Ahmad, said in the bank’s annual report, “Investments in automation tools are prioritised to streamline processes, reduce costs to serve, and mitigate operational risks.”

Malaysia is expected to be the next data centre powerhouse, with Google making its entry into the market to boost the already increasing demand for AI and cloud services in the country. In an article by NST Malaysia, Dr. Naz’ri Mahrin, dean of Universiti Teknologi Malaysia (UTM) Faculty of Artificial Intelligence (FAI), is quoted saying that the investment by Google is expected to significantly enhance Malaysia’s AI capabilities, strengthening innovation and economic growth.

In Malaysia, AI is already being implemented in various aspects of the financial services institution. We can see a surge in its use in banking, such as Maybank’s MAE app, which is an AI-driven mobile banking app that provides personalised financial insights, budgeting tools, and expense tracking. Following this step, Maybank has sunsetted its older Maybank2u app by 30 June 2024, making it unavailable on every app store.

Recently, it was reported in The Malaysian Reserve that IBPO Group Berhad and TIME dotCom Berhad have partnered to enhance data security for fusion finance to integrate IBPO’s Fusion Financial System and the ANIKA chatbot, Malaysia's first AI-powered virtual financial consultant, into TIME's secure network. ANIKA lets customers enjoy services like checking loan eligibility, potential savings, and personalised financial solutions. The partnership ensures robust data security, scalable cloud hosting, and excellent broadband services to support IBPO’s AI technologies and protect sensitive financial data.

Source: IBPO Group

Based on a study by Accenture, 70% of Malaysian financial services executives anticipate that AI and virtual assistants will shape the future of customer service in their industry, improving the overall customer experience.

Here are some real-world examples of how financial services are already implementing AI in Malaysia:

Smarter Banks, Happier Customers: The AI Advantage

Imagine generative AI as a highly efficient personal assistant who knows every detail of your schedule, preferences, and needs. For financial services institutions, this translates into AI systems that can manage and analyse data, predict customer behaviours, and offer personalised financial advice instantly. Just as a personal assistant can schedule meetings, handle communications, and remind you of important tasks, generative AI automates routine operations, responds to customer queries, and streamlines processes, leading to enhanced productivity and improved customer satisfaction.

A real-life prime example of a bank embracing advanced technology would be Bank Muamalat's partnership with Google Cloud. With Google Cloud's AI capabilities, the bank anticipates improved personalised services and explores the use of generative AI to automate routine tasks such as investment research, marketing, customer segmentation, as well as customer acquisition and retention strategies. This innovation allows staff to focus on complex customer interactions, improving service quality. More companies are adopting generative AI to automate tasks to increase their productivity. For example, employees at Permodalan Nasional Berhad (PNB) and AmBank are experiencing improved efficiency and creativity in their work. PNB is a pioneer in Malaysia to implement Copilot for Microsoft 365, leveraging on the platform’s usability to ease the transition to remote working environment, enabling an efficient, collaborative and secure workspace regardless of location. Copilot aids in data analysis, intelligent searches, and automated meeting summaries. PNB's Chief Technology Officer, Ts. Izzat Aziz, highlighted Copilot's ability to swiftly decipher large contexts and generate relevant insights. At AmBank, Project Manager Rozidatul Akmal Kamil commended Copilot’s features, such as summarising meeting discussions, saving time on minute-taking.

In addition to streamlining tasks, AI-driven chatbots and virtual assistants can handle a variety of customer enquiries efficiently and accurately. For example, virtual assistants like the one implemented by Mashreq Al Islami Bank, partnering with AI company Kore.ai gives its customers personalised self-service and faster resolution of customer queries in both Arabic and English. This not only reduces the workload for employees but also ensures that customers get accurate responses, leading to higher satisfaction rates.

Moreover, AI algorithms can analyse customer data to offer tailored financial advice and products. By understanding individual customer needs and preferences, banks can recommend relevant services and products, thereby improving customer engagement and loyalty. For instance, AI-powered financial planning tools like Finalyst help financial planners identify potential shortfalls in financial planning. This not only enhances wealth management but also streamlines adviser-client relationships through Finalyst’s automated, user-friendly interfaces. This helps their customers manage their finances more effectively by providing personalised budgeting and investment advice.

Source: Nazrul Irwan Mohd Nor

From Ideas to Impact: Generative AI Labs Fueling Innovation in Malaysia

The financial services institution is also seeing great lengths of innovation in the research and development of generative AI. Recognising this potential, HELP University and Alliance Bank Malaysia has joined forces to establish the country’s first generative AI lab. This partnership showcases how academia and finance can unite to foster innovation to enhance the development of generative AI, especially in the financial services industry. This results in the educators and students driving the banking industry together, aiding banks to make more informed decisions, reduce survey costs, and foster innovation in product design. Additionally, HELP University said in a statement that with extensive collaborative effort given in researching generative AI, the finance industry gains a competitive edge as it gives them the ability to develop powerful AI predictions on product performance and prospects.

With that, understanding the importance of emphasising research and development in AI allows the financial sector to innovate its risk management strategies and product development to meet industry challenges. Generative AI can simulate various market scenarios and predict potential risks, enabling banks to develop robust risk mitigation strategies. In 2023, a total of 317,435 suspicious transaction reports (STRs) were filed with Bank Negara and out of those numbers, 23% were suspected of fraud.

To tackle this risk, Bank Negara’s financial intelligence unit leveraged on data and AI to identify unusual patterns and behaviours of suspected fraud, enabling them to take proactive measures to prevent crimes. Moreover, in product development, generative AI helps create new financial products and services that cater to emerging customer needs. By analysing market trends and customer data, AI suggests innovative solutions that enhance the value proposition of financial institutions. An example of a bank already offering such service is US-based bank, JPMorgan with its IndexGPT, launched earlier this year in a new series of indexes utilising GPT-4, the latest iteration of OpenAI's deep-learning technology. IndexGPT is a component of J.P. Morgan’s strategic indexes business, which creates systematic, rules-based trading strategies packaged into indexes for institutional clients. These indexes span major asset classes and geographies, addressing common investment themes.

Hackathons ‘Hacking’ Talent Management Transformation: Hong Leong Bank's AI-Driven Talent Success

In order to innovate their talent development within the organisation, Hong Leong Bank organised Malaysia’s first hackathon focused on Generative AI as part of its sixth annual ‘HLB Can You Hack It’ event. The participants, which consisted of 90 teams of students, fresh graduates as well as working professionals, devised solutions using AI to enhance customer experiences and boost workplace efficiency within the banking sector. As a result, the grand winners created an AI-powered end-to-end employee onboarding platform for new hires and customer-facing staff that enhances the organisation’s talent development programmes. This event is a clear example of how banks are seeing the high value in generative AI and leveraging on an opportunity to engage with young minds who are the future of banking and the workforce.

This shows how generative AI is changing the landscape of talent development in improving decision-making, predicting skills gaps, and ensuring an inclusive talent management process. In a report by the Boston Consulting Group, generative AI is revolutionising human resources by enabling customised HR self-service capabilities and fostering a more integrated talent ecosystem.

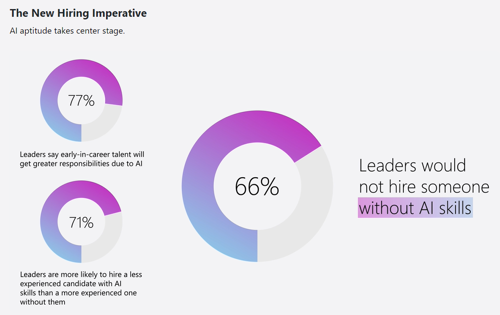

It is clear that Hong Leong Bank sees generative AI as a key tool that is showing an upward trend in talent management. According to the Word Trend Index 2023, 66% of employers say they will not hire someone without AI skills whereas 71% prefer to hire someone less experienced with AI skills rather than an experienced candidate without them. It is no wonder that organisations like Hong Leong Bank sees generative AI as an opportunity they have to take.

Source: Work Trend Index 2023

An AI-Powered Decision: autoML Driving Strategic Success and Risk Mitigation

Juris Mindcraft's autoML platform showcases AI's transformative power in banking, enhancing intelligent decision-making. By processing vast data sets, it provides banks with critical insights for strategic actions and solving complex financial issues with speed and accuracy. AutoML streamlines the creation and deployment of machine learning models by automating parts of the development process, allowing financial institutions to utilise AI insights without deep technical knowledge. This enables quick, precise data analysis to detect patterns and inform strategic choices.

For instance, autoML helps banks optimise investment portfolios by identifying top assets and forecasting market trends, improving portfolio performance and enabling swift market adaptation. It also advances credit risk assessment by analysing borrower data to predict defaults, helping banks better manage risks. AutoML's data-driven insights aid banks in enhancing profitability, reducing risks, and boosting operational efficiency, ensuring they remain competitive by using technology for smarter, faster, and more reliable decision-making.

Cracking the Code: Why AI Explainability Matters

The Malaysian financial services industry is progressing in its adoption of generative AI, making it essential for users to comprehend how these AI systems form conclusions. Understanding AI algorithms is crucial for effective decision-making, risk management, and boosting customer satisfaction. Explainable AI, which clarifies how decisions are made, builds trust and transparency, especially in critical areas like credit scoring where AI's impact is significant. Additionally, it helps ensure regulatory compliance by showing that AI decisions are fair and unbiased, helping financial institutions manage legal and reputational risks effectively.

Preparing for the Future with Generative AI

Given the current trend towards adopting AI technologies, what happens to those who do not get on board? Failure to do so can result in falling behind competitors, losing market share, and missing out on significant opportunities for growth and efficiency. Generative AI proficiency also facilitates the implementation of best practices when handling data for AI-driven tasks. The first step is to upskill the self with the knowledge of generative AI to understand the input data in order to make an informed decision.

Recognising the need for generative AI literacy, Excelerate offers courses designed to enable teams and organisations enhance their capabilities in integrating AI into their workflows. The company’s tailored programmes have successfully partnered with top banks nationwide, helping them scale up their entire banking operations to bridge existing digital skills gaps within their organisations.

Excelerate’s generative AI for work courses empower employees by upskilling them with automating routine tasks, fostering innovation, and enhancing productivity. Professionals can leverage on the courses to integrate AI seamlessly into their daily operations, transforming how they approach problem-solving and decision-making. Similarly, generative AI for data courses are also available that provide deep insights into leveraging AI for data analysis, ensuring teams can make data-driven decisions with confidence. These courses are specifically designed to equip companies with the tools and knowledge needed to stay ahead in the competitive financial services environment.

Embrace AI with Excelerate and future-proof your organisation. Find out more here: https://excelerate.asia/gen-ai/

View Related Courses

This Article Is Tagged Under

Nik Sharmine A

Published on Jul 17, 2024

Share this Article

Related Articles. Here’s what we’ve been up to recently.

Beyond Antivirus: Protecting Your SME Business from Evolving Cyber Threats

Computer viruses have existed since the inception of the internet. Over the years, they have evolved and adapted alongside advancing technologies. This blog explores how cyber threats have impacted businesses over time and why a multi-layered approach, beyond just antivirus software, is necessary to protect SMEs.

Aug 16, 2024

Excelerate Courses Now Recognised by Malaysia Board of Technologists (MBOT)

Kuala Lumpur, 10 July 2024 – Excelerate announces that all our in-house courses—Generative AI at Work, Generative AI for Data, and Data Storytelling—have received official recognition from the Malaysia Board of Technologists (MBOT).

Jul 10, 2024

Generative AI: The Game-Changer for Malaysian E-commerce Success

Discover how Generative AI is transforming Malaysian e-commerce. From improving customer experiences to optimising operations, the e-commerce industry has adopted AI to improve productivity and efficiency. Learn about the benefits and real-world applications driving e-commerce success and positioning Malaysian businesses at the forefront of the digital marketplace. Explore the transformative power of Generative AI and its impact on the future of e-commerce in Malaysia.

Jul 26, 2024